UPDATE: 5/8/2021

As of 5/4/2021, the SBA has stopped accepting PPP applications from most lenders. The SBA announced the general fund is out of money. However, there are funds set aside that are available for community financial institutions (CFI). CFI’s usually work with businesses in underserved areas. If you qualify and have not applied for PPP 2, I recommend doing a web search to find if there is a CFI near you.

The second stimulus bill recently placed into law includes PPP round 2. Below, I have listed and explained many of the details to help you determine if you qualify and how to go about the process if you do.

Information contained in this article was updated on 2/1/21.

Do You Qualify?

NOTE: If you received PPP 1 in 2020 then you will need to meet the qualifications of PPP DRAW 2, listed below. However, if you did not receive PPP 1 in 2020 then you can apply for DRAW 1. PPP Draw 1 does not require the income test listed below.

To qualify you must be able to prove that gross sales have decreased by at least 25% in one quarter of 2020 compared to 2019.

What this means: Compare quarter 1 of 2020 to quarter 1 in 2019 and see if 2020 shows at least a 25% decrease in gross sales. If not, move to quarter 2 and compare 2020 to 2019. And so on.

The qualification is based on comparing the same quarter from 2019 to 2020. You only need one quarter that shows at least a 25% decrease to qualify.

Pro Tip: First, you need to make sure the information you are using for comparison is accurate. Also, you need to understand what amounts make up “gross sales”.

Also, it’s my understanding that most of the proof that you qualify will need to be provided upon forgiveness and not with your application. If this turns out to be true, please be careful. You need to be completely sure that you qualify for the PPP before receiving it. Don’t put yourself in a position of possibly not having the loan forgiven or worse.

Scroll to the bottom for additional qualifications.

What are gross sales?

- PPP funds received

- EIDL funds received

- grants or ANY type of loan

- unemployment income

- deposits of your personal funds into your business bank account

- deposits from a Line of Credit

- gains on investments

- W2 wages

Pro Tip: If you qualify and would like to apply for PPP 2 you will want to check with your lender and see if they are participating in this round. Some banks that participated in round 1 have chosen to not take part in round 2.

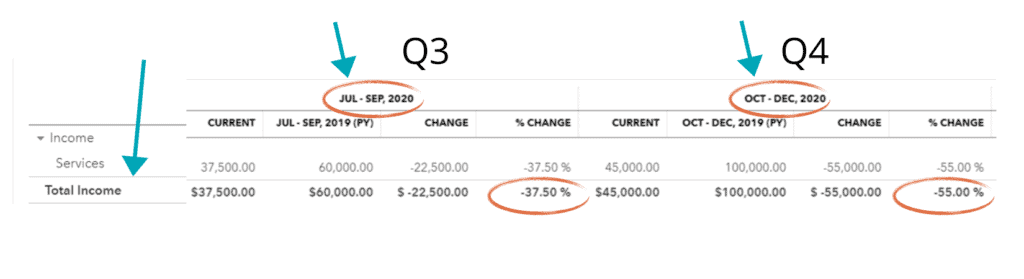

QBO Report to use to Determine Income Qualification

If you are using QuickBooks Online you can customize a P&L report to show this information.

In the left toolbar click on Reports and then select Profit and Loss.

1. Select the date range 01/01/2020 to 12/31/2020

2. In the ‘display columns by’ dropdown select QUARTERS

3. In the ‘Compare another period’ dropdown select PREVIOUS YEAR and put a checkmark next to $ change & % change

4. Select CASH basis if you file taxes on a cash basis. Select Accrual basis if you file taxes using this method.

5. Click ‘RUN REPORT’

6. Take a look at Total Income. In Q1 the change in income between 2019 and 2020 was positive 57.14%. This is an increase in 2020 compared to 2019. This quarter does not meet the qualifications for PPP round 2.

7. Take a look at Total Income for Q2. The change in income between 2019 and 2020 was negative 13.57%. This is a decrease in 2020 compared to 2019. However, this quarter does not meet the qualifications for PPP round 2 since it’s not at least 25% less.

8. Take a look at Total Income for Q3. The change in income between 2019 and 2020 was negative 37.5%. This is a decrease in 2020 compared to 2019. Since the negative change is at least 25% this business would qualify based on this one quarter if they meet the other qualifications.

9. For this exercise there is no need to move on to Q4. However, it does show a negative change of at least 25%.

Approved Uses of PPP 2 Funds

Approved uses of PPP 2 funds are similar to PPP 1.

- A minimum of 60% must be used for payroll.

- No more than 40% can be used for rent, utilities, and certain types of interest.

There are some new approved areas for this round, you will want to read the legislation closely to make sure you understand what each category entails.

- Certain types of covered operation expenses, covered property damage cost (such as from looting in 2020 not covered by insurance), covered supplier cost, and some PPE cost. Again, be sure to read the legislation to make sure you use the funds properly for forgiveness.

Calculate the loan amount

The loan amount is based on payroll like round 1. However, this time the borrower can base their payroll amount on either 2019 payroll or 2020 payroll. You would want to select the year with the higher payroll.

Calculation for Businesses with W2 Employees

For businesses with W2 employees, the calculation is average payroll times 2.5. You find the average payroll by taking either the 2019 or 2020 payroll, then divide by 12, and then multiply by 2.5. Individual payroll amounts are capped at $100,000. Be sure to read the fine print on what all can be included in gross payroll for your business’s tax structure. Such as state unemployment tax, health insurance paid by the employer, retirement paid by the employer, and group life, vision, dental, and disability paid by the employer. Read all of the instructions provided to make sure you calculate payroll accurately.

The term payroll is used incorrectly quite often. Payroll is paying an employee routinely, removing taxes from their pay, remitting the taxes to the IRS and state authorities, and issuing a W2 each January. Refer to this article on payroll for more details on the process and who should be on payroll.

Businesses with no W2 employees. Including, Independent Contractors, Gig Workers (Schedule C & F income tax filers)

For business owners without W2 employees (Schedule C or F on the tax return); including independent contractors and gig workers your calculation is based on net income on your Schedule C for either 2019 or 2020. Maxed out at $100,000. For the calculation, take net income and divide by 12 then multiply by 2.5 for the loan amount.

For example, if net income for 2020 is $90,000 and net income in 2019 was $135,000 go with the higher amount. For $135,000 you would use the max amount of $100,000. The calculation is 100,000 / 12 = 8333.33 Multiplied by 2.5 = 20,833.33

$20,833.33 is the maximum amount with the cap of $100.000.

Pro Tip: You will be applying for PPP 2 before filing your 2020 tax return. If you feel that your 2020 net income is higher than in 2019 you will want to create your Schedule C for 2020. (However, if both years are above $100,000 then there is no need since the calculation is capped with a net income of $100,000.) Use your 2019 Schedule C as a guide and the form instructions located on the IRS site. For this, you will need an updated and accurate P&L.

NOTE: You could meet both scenarios. If you file a Schedule C or F AND have W2 employees you could apply for two separate loans. One for your employee payroll and one for your draws.

Self-Employed - Schedule C & F Filers - Documents & Verbiage

This information is important and can be critical for you to know to help push your loan request through quickly.

If you file a Schedule C or F, as the owner you are not an employee of the company so you cannot be on formal payroll. Instead, you take draws.

When you apply you will not have payroll documents to submit since you aren’t on payroll. Instead, the calculation is based on your net income on Schedule C (refer to the Calculate the Loan Section above). However, during PPP round 1 many lenders did not understand this. If your lender asks for payroll documents just explain that as the owner of your entity type the IRS does not allow the owner to be on payroll.

To further complicate the process, on the SBA application all of the verbiage related to amounts are labeled as payroll. Don’t let this confuse you, just add your amounts in these cells.

Additional Details

- The business must have been in existence on 2/15/2020.

- You, as the borrower can select either an 8-week or 24-week period to use the funds. The 24-week period may be optimal.

- If funds are spent properly the loan can be forgiven.

- PPP amounts forgiven are not treated as income.

- PPP funds used for approved expenses and forgiven will be deductible on the tax return.

- PPP forgiveness is not reduced down by the amount of your EIDL grant/advance. See this article for clarification.

- Any amounts not forgiven will have a 5 year repayment period with 1% interest, not compounded.

- You, as the borrower, must not employ more than 300 employees.

- There is a special calculation for seasonal businesses. The average monthly is based on a 12 week period between 2/15/19 & 2/15/20.

- Certain entities in the food and lodging space multiply average payroll by 3.5 and not 2.5. The businesses that qualify have a NAICS code starting with 72. Check your prior tax return for your NAICS code.

- If you qualify, you may apply for round 2 regardless if you received round 1 or not.

- Closed businesses may not apply.

- If you qualify, you may apply even if you received PPP 1 and have not completed the forgiveness process.

How Will You Apply?

If you received PPP 1 and felt the process with your lender went smoothly then it might be easier to use that lender for round 2, if they are participating.

If your lender isn’t participating in this round or you weren’t happy with the lender you used, you have lots of choices. If you go with a bank you will need to have an account with them. Some banks are requiring that business owners must have been doing business with the bank for a certain time period. This helps the banks to weed out new accounts that will only be used during the PPP timeframe. It might take a little research to find a bank that’s right for you.

There are also many non-bank lenders. I had several clients go this route for round 1 and had great experiences. Many of these will come up in a web search with the keywords PPP lender list. The SBA had a list on their site for round 1 but I haven’t seen one yet for round 2.

NOTE: The SBA has said that a borrower may apply with more than one lender. However, only one loan will be approved. This can be beneficial if the initial bank you are working with is hard to deal with.

ALERT: Please keep in mind, the PPP guidelines are universal. Meaning, all lenders must adhere to the guidelines provided by the SBA. However, not all lenders or loan officers understand all of the guidelines in the program. If you feel your lender is asking for documentation not required or has approved you for a lower amount speak up. If that doesn’t rectify the situation move on to another lender. While I never want to add additional stress to anyone there isn’t time to waste. So move on if necessary.

If you qualify and would like to apply you will need to do so immediately, as soon as the program opens. In the meantime, get your payroll information or Schedule C together AND make sure your accounting system is up-to-date with accurate information. You want to make sure the gross sales number you use for comparison is accurate. You will also want to make sure your lender is participating and if not select another lender.

When further guidance is available on this program I will update this post.

HAVE QUESTIONS

We provide consulting for small businesses and sole proprietors. We can help you with any number of things including helping you determine gross sales and quarter over quarter change. Send us an email at Hello@SensibleBusinessOwner.com to set up a time. Rates are from $57.50 for a 1/2 hour.

If you found this article helpful leave us a comment. We enjoy hearing from you.

~ Brandon & Christi are successful business owners who enjoy traveling and making a mess in the kitchen with their two daughters. They reside in the Dallas, TX suburbs and work with businesses throughout the U.S.

The article is for informational purposes only and should not be construed as business, accounting, tax, or legal advice. Details are from the latest PPP 2 legislation as of the date of this post. Details are subject to change without notice. It is wise to seek financial counsel before proceeding with any loan application.

Copyright © 2020-2021, Brandon & Christi Rains, Rains Group LLC DBA The Sensible Business Owner, ALL RIGHTS RESERVED

Great read! Thank you!

You are welcome Renee. I am glad it was helpful! – Christi