Are you thinking about giving business gifts this holiday season?

Many business owners give gifts to business associates during the holiday season. Whether it be a client, vendor, referral partner, or colleague. Giving an unexpected gift could help set you apart from your competitors. However, there are special rules around gift-giving that you should be aware of.

The IRS allows for a business to deduct the cost of purchasing a gift for a client, customer, vendor, etc. But like most IRS rules there are limits. The deductibility of a business gift is up to $25.00 a year, per person. If you pay $50 for a client gift, only $25 is deductible. If you give two gifts to the same person in one calendar year only a total of $25 is deductible.

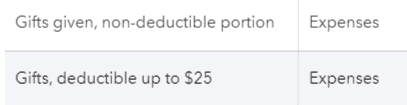

I recommend you have two accounts on your chart of accounts to track the difference. One account labeled ‘gifts, deductible up to $25′ and a second account labeled ‘gifts, non-deductible portion’. (See the graphic below.)

One thing to keep in mind, incidental costs that do not add substantial value to the gift such as gift wrapping, mailing, or engraving, generally do not count towards the $25 cap. (Information from IRS Publication 463)

Be sure to keep track of the gift recipient, business purpose, amount, etc.

$25.00 might not sound like a lot for a gift and purchasing a gift that costs more is perfectly fine. However, it doesn’t help to lower your tax liability. You might have to get creative but I bet you will be surprised how many affordable yet nice gifts are available during the holiday season. Gourmet chocolates and candies are almost always well received!

PRO TIP: Cards are not considered gifts and are 100% deductible. I code the purchase of cards to a general business expense.

My 2 Cents: When I give gifts I make the gift less about me (and my business) and more about the gift receiver. I don’t give gifts that include my company logo. To me, this seems impersonal.

I hope this mini-tip helped you! If you give business gifts let us know in the comments. (Information from IRS Publication 463)

~ Brandon & Christi are successful business owners who enjoy traveling and making a mess in the kitchen with their two daughters.

The article is for informational purposes only and should not be construed as business, accounting, tax or legal advice. Details are subject to change without notice.

Copyright © 2018-2022, Brandon & Christi Rains, Rains Group LLC DBA The Sensible Business Owner, ALL RIGHTS RESERVED